[ad_1]

Oil and gas industries just enjoyed a bumper gain year, with shareholders looking at history payouts. In its wake, Europe’s Shell and BP each walked again on their ambitious small-carbon transition options, with corporations throughout the sector increasing their investing in new output.

That’s not good news for local weather adjust, mostly pushed by burning fossil fuels. One particular be concerned is these investments indicate the market and its political allies will struggle tooth and nail for them to stay clear of “stranded property” losses, locking in increased generation of weather modifying fuels for a long time and even a long time to arrive.

Not only the companies, but also their shareholders could convert, as vested passions, into a broad coalition versus eco-friendly electrical power. At the very least in the U.S. and the U.K., most pensions are invested in capital markets, in which within stock marketplaces oil and fuel providers keep on being amid the most trustworthy turbines of dividends and share buybacks. All of this could deter governments from utilizing all-far too-ambitious climate mitigation procedures for panic of causing fiscal losses to a broad swath of their own voters.

But dependent on a current investigation, we argue that significant-profits governments need not be concerned about triggering these fiscal losses. That is due to the fact most hits from stranded fossil fuel assets—lower manufacturing volumes or gross sales at lower prices than buyers expected—would fall largely on the wealthy customers of these nations around the world. That ain’t most voters.

The clarification is comparatively basic: these nations all have major inequality in who owns firms. That implies the rich generally individual the extensive greater part of all shares and bonds, and there is no proof that differs noticeably in the oil and fuel sector.

Governments must certainly fear about possible consequences on the buyers of fossil fuels, amongst vehicle house owners for illustration, prompted by carbon selling prices and other climate insurance policies that impose penalties on intake, and there have been significant proposals for steps to lower the adverse effects of fossil gasoline phaseout on the most vulnerable people in culture, these kinds of as “carbon dividends” and enhanced public transportation. Governments ought to also stress about employees in the energy and other sectors and make sure a just changeover for fossil fuel communities. Nonetheless, for financial investments, the bottom 50 percent and even 90 p.c of wealth entrepreneurs could be compensated at incredibly small expense in comparison to these other actions.

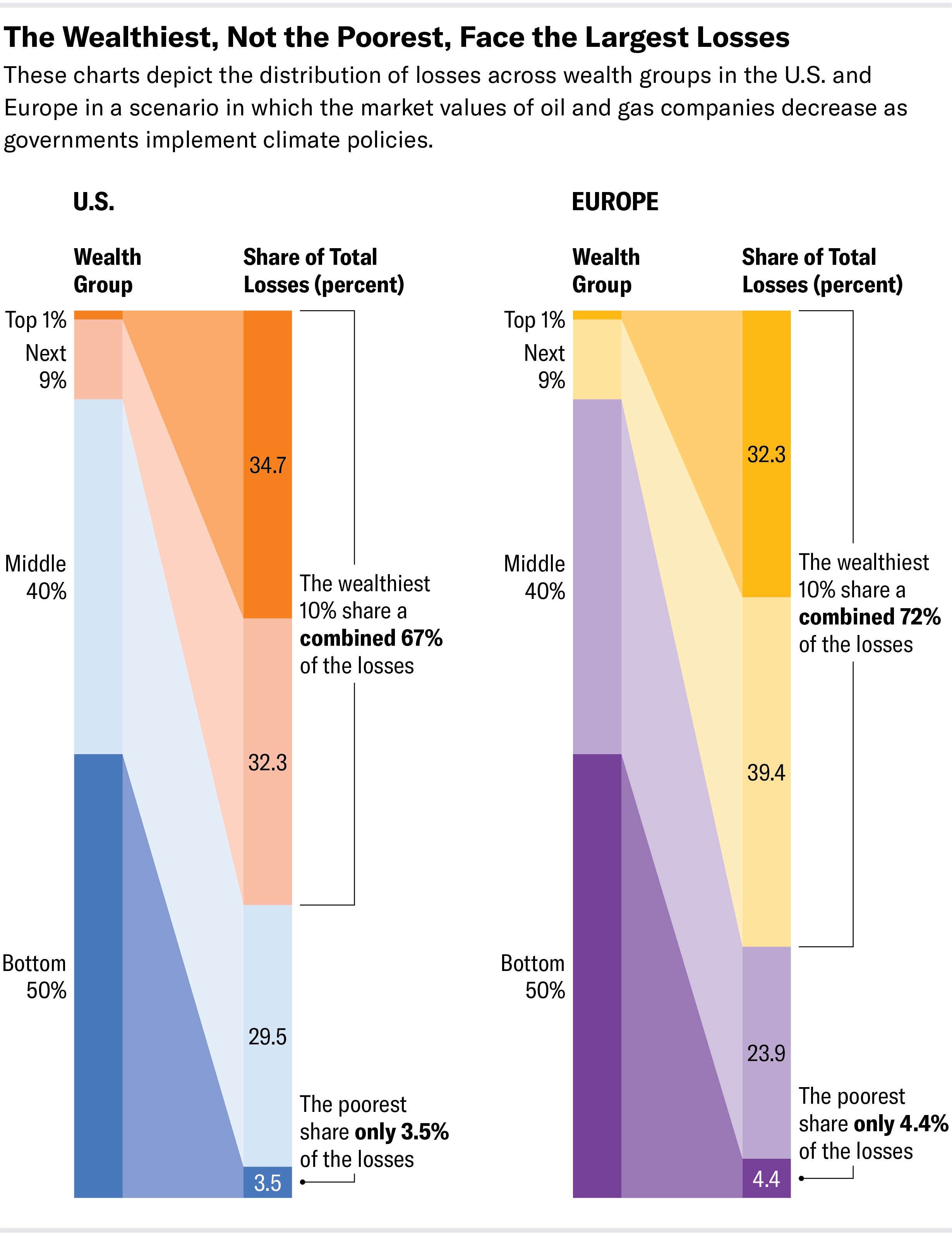

We have formerly calculated that in a scenario exactly where oil and gas companies are to begin with valued dependent on an expectation of participation in a increasing oil and fuel industry, but governments around the environment employ climate procedures restricting world-wide warming to 2 levels Celsius over preindustrial averages, this could lead to prosperity losses of practically $550 billion for U.S. and European shareholders as companies’ industry values are readjusted to these reduce anticipations. Having said that, when we examine where by these shareholders are probable to sit in the wealth distribution, it turns out that only 3.5 p.c in the U.S. and 4.4 % in Europe of the losses damage the portfolios of the bottom 50 per cent of them (see chart). Simply just put, these who individual most shares, also personal most of the oil and gas sector shares that get devalued.

Simply because the top rated 1 percent and best 10 per cent are so wealthy having said that (each U.S. American adult in the top 1 % owns a lot more than $13 million in web prosperity on average) these losses, distribute across men and women, hardly clearly show in their portfolio. We estimate that losses volume to significantly less than 50 % a % of the net wealth of wealthiest 1 percent or 10 % of Individuals, for instance. Furthermore, as fossil fuels decline, new investment decision options emerge in the increasing markets for small-carbon alternate options that permit for portfolio hedging. Even losses for the the very least rich 50 per cent and 90 % are not significant as a percentage of their prosperity. The problem could crop up from the truth that they have so very little prosperity in the initial spot. Compensating the base 50 per cent would expense just $12 billion in the U.S. and $9 billion in Europe in a $550 billion loss scenario. This could be compensated off with just a person sixth of the annual profits from a notional $13 for each ton of carbon dioxide emissions rate in the U.S., which is a lot reduce than latest consensus estimates of the social value of carbon. In Europe, it could also be paid off with around 20 p.c of the profits from the European Emissions Buying and selling Process (ETS) in 2022.

A person could argue that the wealthy are a great deal more innovative buyers and will get out of their investments ahead of the shares drop their benefit, saddling the very poor with substantially a lot more of the losses. This is certainly a issue, nonetheless our robustness calculations advise that even if the poor were considerably a lot more most likely to individual oil and fuel shares, compensation charges would stay constrained.

There are quite a few hurdles to shifting away from fossil fuels, from rates for consumers and firms to work and indicating in communities exactly where fossil fuel creation is concentrated. Governments need to tackle them all thoroughly. Even so, losses for money investors really don’t rank amid them, and even if they have been, we show that compensation for any socially related losses would be cheap in truth.

Warnings about pension losses and pushback from measures that would result in asset stranding show up mostly designed in the interest of the extremely rich, whose capacity to take up losses is arguably substantially larger than anyone else’s. Losses from unmitigated climate adjust, on the other hand, will most likely strike the inadequate and vulnerable significantly more durable.

This is an viewpoint and evaluation posting, and the sights expressed by the author or authors are not automatically these of Scientific American.

[ad_2]

Source url